Keeping track of expenses can be a challenging endeavor in the dynamic realm of personal finance. We often find ourselves staring at our bank statements, wondering where our hard-earned money vanished.

But fear not, AI expense tracker apps are here to revolutionize your financial management experience.

Imagine having a personal financial assistant that effortlessly tracks every penny you spend, providing real-time insights into your spending habits.

These intelligent tools can even nudge you towards your savings goals.

Did you know that the average person spends 2.5 hours per week managing their expenses? That’s a significant portion of your time that could be better spent enjoying life’s pleasures.

With the right AI expense tracker app, you can cut that time in half, leaving you more room for relaxation and pursuits.

Are you ready to bid farewell to financial confusion and embrace clarity? Let’s embark on a journey to discover the best AI expense tracker apps that will transform your budgeting woes into a harmonious financial symphony. It’s time to take control of your finances and unlock your financial potential.

Best AI Expense Trackers

1. Mint.intuit.com

One thing that makes mint.intuit.com stand out is that it makes handling your money easier. Imagine that as soon as you link your accounts in Mint, the smart algorithms start carefully sorting your activities into the right categories. Having a hardworking assistant help you solve your money problems is like having a helper.

Mint’s ability to make a full picture of your finances is what makes it so useful. Think of it as an artist drawing a picture of your income and spending.

Mint not only tracks your spending but also analyzes patterns, providing insights into your financial habits. It’s more than a tracker; it’s a financial advisor, helping you understand where your money goes and how you can make informed decisions.

Creating budgets and financial goals helps Mint understand your priorities. It’s like talking to a trusted advisor; your preferences affect the advice and information you get. It’s not just about keeping track; it’s about giving you the power to take charge of your financial journey.

Mint’s notifications act as friendly nudges. Imagine receiving a gentle reminder when you’re approaching your budget limit or when an unusual expense occurs.

It’s like having a financial companion watching over your shoulder, ensuring you stay on track and avoid surprises.

Key features

1. Transaction Categorization

Mint’s AI engine categorizes your transactions intelligently, streamlining the process of understanding where your money goes. It’s like having a personal assistant organizing your financial life, from groceries to utility bills.

2. Budgeting Insights

Mint goes beyond mere tracking; it’s your financial advisor. By analyzing your spending patterns, it provides insights to help you set realistic budgets. Think of it as a wise counselor, guiding you towards financial goals.

3. Goal Setting and Tracking

With Mint, you’re not just tracking expenses; you’re achieving financial milestones. Set savings goals, and watch Mint monitor your progress. It’s like having a coach cheering you on as you save for that dream vacation.

Pros

1. Real-Time Expense Tracking

Mint offers real-time tracking, ensuring you stay in the loop with your spending habits. It’s like having a financial radar, keeping you informed as transactions happen.

2. Financial Snapshot

The tool provides a comprehensive overview of your finances. Imagine a bird’s eye view of your income, expenses, and net worth. It’s like having a financial map, helping you navigate your monetary landscape.

Cons

1. Sensitivity to Account Connections

Some users may experience occasional sensitivity in connecting and syncing accounts. Patience is key, as Mint diligently works to maintain the accuracy of your financial data.

2. Limited Customization

While Mint offers robust tracking, highly customized categorization for unique expenses might be limited. Users desiring highly personalized categories may find some constraints.

Frequently Asked Questions About Mint

How does Mint ensure the security of my financial information?

Mint employs bank-level security with encryption and authentication measures. It’s like having a secure vault for your financial data.

Can Mint help me plan for future expenses?

Absolutely. Mint’s budgeting features and goal-setting functionality empower you to plan and save for future expenses. It’s like having a financial planner at your fingertips.

2. Goodbudget

Goodbudget takes the complexity out of budgeting, functioning as a reliable AI-driven expense tracker that transforms your financial management into a seamless and accessible process. As you start using Goodbudget, consider a programme that functions as your digital financial assistant.

More than just a simple expense tracker, it acts as a kind of virtual financial coach, providing insights into where your money is going and what you can do to put it to better use. You can consider Goodbudget a constant companion since it eases the stress of budgeting.

Think about how interested you are in setting financial goals. Goodbudget does more than just keep track of your spending. When you use it, picture a tool that fits your life perfectly.

It is easy to integrate into your regular financial activities, keeping you informed at all times. It’s like having your very own financial magician who can take your income and expenses and magically turn them into a story you can understand.

Goodbudget isn’t just an expense tracker; it’s a partner in your financial journey. It operates with a simplicity that belies its powerful capabilities, turning the often daunting task of budgeting into an enjoyable and empowering experience.

Key features

1. Digital Envelope System

At the heart of Goodbudget lies its unique digital envelope system. Imagine having digital envelopes for various spending categories, such as groceries or entertainment. Goodbudget empowers you to allocate funds to these virtual envelopes, giving you a tangible and visual representation of your budget.

2. Real-time Transaction Tracking

Goodbudget excels in real-time tracking. Picture this: you make a purchase, and within moments, Goodbudget updates your virtual envelopes. It’s like having a financial GPS, providing you with instant feedback on your spending.

3. Shared Budgeting

Goodbudget fosters collaboration. Envision a scenario where you and your partner share a budget, each contributing to the financial plan. It’s like having a shared canvas where both of you actively participate in shaping your financial landscape.

Pros

1. User-Friendly Interface

Goodbudget boasts a user-friendly interface, making it accessible to individuals regardless of their familiarity with budgeting tools. It’s like having a personal financial assistant that speaks your language.

2. Envelopes Promote Conscious Spending

The digital envelope system encourages mindful spending. Think of it as a conscious decision-making tool, guiding you to allocate and spend money intentionally within predefined categories.

Cons

1. Manual Transaction Entry

One aspect to consider is the manual entry of transactions. While this ensures accuracy, some users might find it slightly time-consuming compared to fully automated systems.

2. Learning Curve for New Users

For those new to the envelope budgeting concept, there might be a brief learning curve. However, once understood, it becomes a powerful tool for financial control.

Frequently Asked Questions About Goodbudget

Can I customize the envelope categories?

Absolutely. Goodbudget allows you to customize envelope categories based on your specific needs. It’s like tailoring your financial plan to fit your lifestyle.

How does Goodbudget ensure security with manual entries?

Goodbudget values user privacy. Manual entries are stored securely, ensuring that your financial data remains confidential. It’s like having a secure vault for your transactions.

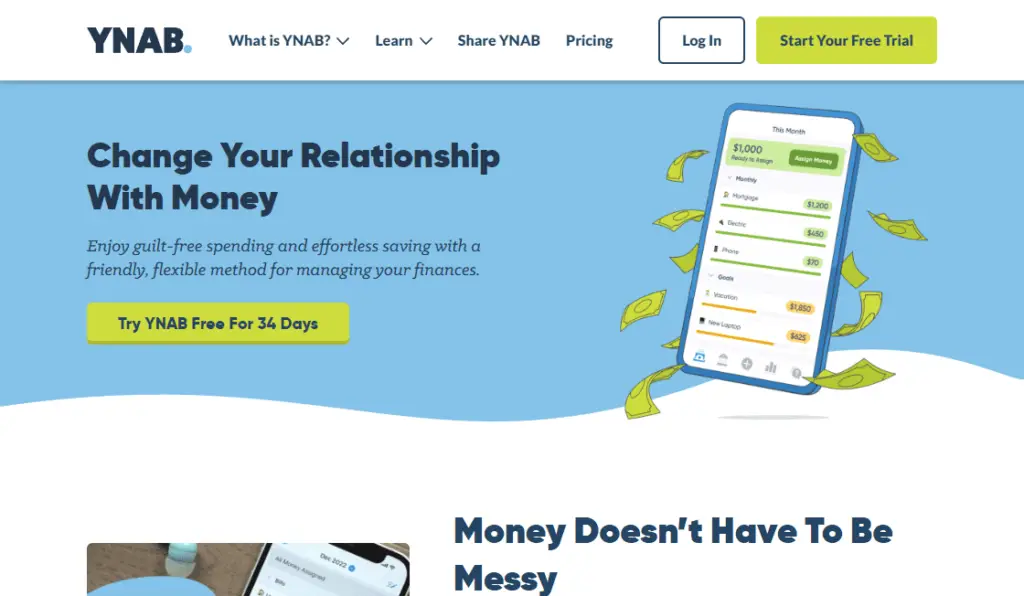

3. You Need a Budget (YNAB)

YNAB transcends being just an expense tracker; it transforms budgeting into an engaging and empowering experience.

Its outlook and methodology make it a trustworthy friend on the road to financial security and success. Think of YNAB as a helpful guide who is patient and well-versed in the ways of money as you explore its features.

In your financial journey with YNAB, the tool operates on the principle of assigning every dollar a job. It’s like having a financial GPS that directs each of your dollars toward a purpose, be it bills, savings, or discretionary spending. This method ensures that every aspect of your budget has a clear destination.

As you interact with YNAB, imagine a tool that encourages you to live on last month’s income. It’s not just about tracking current expenses but about anticipating and planning for the future.

YNAB becomes your forward-thinking financial companion, empowering you to break the paycheck-to-paycheck cycle.

Your involvement is crucial in YNAB’s effectiveness. As you actively engage with your budget, assigning jobs to your dollars and adjusting categories as needed, you’re not just using a tool; you’re shaping your financial reality.

If you want to be an active participant in your financial decisions, YNAB can help by acting as a helpful partner and giving you a place to do so.

YNAB recognizes and accommodates the fact that life is never predictable. It’s like having a financial coach that understands unexpected expenses.

A “Roll with the Punches” approach to budgeting, YNAB gives you the freedom to respond to life’s curveballs by adjusting your spending and saving priorities.

Key features

1. Every Dollar Has a Job

YNAB operates on the philosophy of giving every dollar a specific purpose. It’s not merely tracking expenses; it’s about assigning meaning to each dollar, ensuring it aligns with your priorities. Picture it as a financial choreographer, orchestrating your money to dance to the rhythm of your goals.

2. Rolling with the Punches

YNAB encourages flexibility by allowing users to adapt to unexpected financial changes. It’s like having a financial coach, teaching you how to roll with life’s punches and adjust your budget accordingly. This adaptability ensures your budget remains resilient.

3. Age of Money

YNAB introduces the concept of “Age of Money,” where the goal is to age your money like fine wine. The longer your money stays in your budget, the more mature and purposeful it becomes. It’s like watching your financial resources grow wiser with time, contributing to the stability and sustainability of your budget.

Pros

1. Financial Prioritization

YNAB excels in prioritizing every dollar you earn. It acts as a financial conductor, directing your money to work harmoniously towards your goals. Your involvement in assigning each dollar a job is pivotal for success.

2. Flexibility and Adaptability

The tool’s emphasis on “rolling with the punches” ensures flexibility. Life is unpredictable, and YNAB empowers you to adapt your budget to unforeseen changes. It’s like having a financial GPS that recalculates your route when unexpected detours appear.

Cons

1. Learning Curve

Some users may experience a learning curve, especially if new to the concept of assigning jobs to every dollar. However, this initial learning investment pays off in the long run.

2. Manual Transaction Entry

YNAB encourages users to manually input transactions, ensuring accuracy. While this guarantees precision, some users may find it more time-consuming compared to fully automated systems.

Frequently Asked Questions About YNAB

How does YNAB handle unexpected expenses?

YNAB’s “Rolling with the Punches” philosophy encourages users to adjust their budget categories to accommodate unexpected expenses. It’s like having a financial friend that helps you navigate unforeseen financial challenges.

Can I customize budget categories in YNAB?

Absolutely. YNAB allows users to create and customize budget categories based on their unique financial goals. Think of it as tailoring your financial plan to fit your lifestyle.

4. Expensify

Expensify emerges as a proficient companion in managing your expenses, seamlessly integrating technology to simplify the intricate task of tracking your financial outflows.

In the beginning of your adventure with Expensify, the programme begins its magic by easily scanning your receipts.

It is the same as if you had a vigilant assistant looking over your records and ensuring that no expense is forgotten about.

The procedure has been shortened, which relieves you of the burdensome task of entering data manually and saves you time.

The user-friendly interface of Expensify invites your active participation. It’s more than just a bystander to your money management; it’s an active participant.

Like an accomplice who empowers you to take charge. Using its simple interface, you can categorize and add details to your smartphone, turning it into a mobile spending tracking hub.

Expensify adapts to your needs. Expensify works for individuals and businesses alike.

Key features

1. Receipt Scanning Technology

Expensify employs advanced technology to scan and capture data from receipts effortlessly. This feature acts as your digital assistant, ensuring all expenses are accurately recorded without manual input.

2. Intuitive Expense Categorization

The tool simplifies expense categorization, allowing users to easily classify transactions. It’s like having a smart organizer that streamlines your financial data, making it accessible and understandable.

3. Comprehensive Reporting

Expensify excels in generating detailed reports. Picture it as a skilled storyteller that transforms raw data into insightful narratives, offering a comprehensive overview of your spending patterns.

Pros

1. Time-Saving Automation

Expensify’s automation, particularly in receipt scanning, saves valuable time. It’s like having a personal assistant that efficiently handles the tedious task of manual data entry.

2. Adaptability for Individuals and Businesses

Whether you’re managing personal expenses or handling corporate transactions, Expensify adapts seamlessly. It’s a versatile tool that caters to a range of financial needs.

Cons

1. Learning Curve

Some users may experience a learning curve, especially when adapting to new technology. However, with time and exploration, the tool’s intuitive design becomes more apparent.

2. Limited Offline Functionality

Expensify’s functionality may be limited in offline mode. Users who frequently need to track expenses without internet access may find this aspect less convenient.

Frequently Asked Questions About Expensify

How secure is the receipt scanning process?

Expensify prioritizes security. The receipt scanning process is designed with encryption and privacy measures, ensuring the confidentiality of your financial data.

Can Expensify handle multiple currencies?

Yes, Expensify supports multiple currencies, accommodating users with diverse financial transactions. It’s like having a global financial assistant that understands various monetary systems.

5. EveryDollar

EveryDollar stands as a reliable companion in your financial journey, offering a straightforward approach to expense tracking with a user-friendly interface that caters to your individual needs.

Thinking about a tool that will make planning easier as you use EveryDollar. This makes planning easy and even fun, like having an experienced friend walk you through the process.

The tool ensures that you have a clear view of your financial landscape without overwhelming you with unnecessary complexities.

Your work with EveryDollar is very important. Think about a tool that makes you want to be involved, so you can work with others on the budget.

It’s not merely an observer but a partner, allowing you to shape and mold your financial plan based on your unique goals and aspirations. EveryDollar becomes a canvas on which you paint your financial picture.

EveryDollar streamlines this process, making it accessible to users of all levels of financial expertise. It’s akin to having a helpful guide that ensures you don’t miss any detail, guiding you through the labyrinth of expenses with clarity and simplicity.

The tool caters to your specific financial intents, whether you’re meticulously planning each expense or taking a broader view of your overall budget.

Key features

1. User-Friendly Interface

EveryDollar boasts an intuitive interface that simplifies budgeting. It’s designed for ease of use, ensuring that users of all financial backgrounds can navigate effortlessly.

2. Expense Tracking Simplified

The tool streamlines the process of expense tracking. With clear categories and a straightforward input system, EveryDollar ensures that every financial transaction finds its place in your budget.

3. Customizable Budgeting

EveryDollar adapts to your financial intents with customizable budgeting options. Whether you’re planning for specific expenses or taking a broader view, the tool offers flexibility to suit your unique financial landscape.

Pros

1. Clarity in Budgeting

EveryDollar provides a clear view of your financial situation. It’s like having a financial GPS that guides you through your budget, ensuring transparency and understanding.

2. Active User Participation

The tool encourages active user involvement. By becoming an active participant in budgeting, you shape your financial plan, making it a collaborative effort rather than a passive observation.

Cons

1. Learning Curve

Some users may experience a learning curve when first engaging with EveryDollar. However, with its user-friendly design, this learning phase is generally short-lived.

2. Limited Automation

EveryDollar may have limited automation compared to more advanced tools. Users seeking extensive automation features might find this aspect less comprehensive.

Frequently Asked Questions About EveryDollar

How does EveryDollar handle recurring expenses?

EveryDollar allows users to set up recurring expenses easily. This feature ensures that regular bills and expenditures are factored into the budget consistently.

Can EveryDollar sync with bank accounts?

Yes, EveryDollar offers the capability to sync with bank accounts, providing real-time updates on transactions and balances.

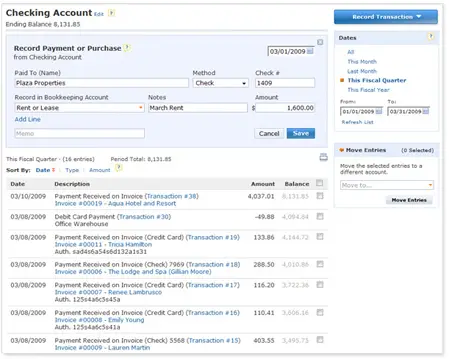

6. WorkingPoint

WorkingPoint emerges as a reliable companion in the realm of expense tracking, bringing a personalized touch to your financial management.

Its conversational tone, intuitive design, and collaborative approach make it a standout choice for users seeking an AI-driven solution to streamline their expense tracking endeavors.

When you start using WorkingPoint, it feels as if you’ve gained a digital companion dedicated to streamlining your financial tasks.

The app is crafted with a user-friendly design, ensuring that every interaction is intuitive and accessible. Your engagement with WorkingPoint becomes an extension of your financial journey, allowing you to effortlessly manage and categorize your expenses.

Also, WorkingPoint adopts a conversational tone, making the process of expense tracking feel less like a chore and more like a friendly discussion about your financial well-being.

Its language is clear, avoiding unnecessary jargon and ensuring that even users with a 6th-grade understanding of finances can comfortably navigate the app.

As you explore WorkingPoint, it becomes evident that the tool doesn’t just record numbers; it actively participates in your financial story.

WorkingPoint doesn’t just provide a platform for tracking expenses; it establishes a connection with your financial goals.

The app becomes a partner in your journey toward financial awareness and responsibility. Through a combination of simplicity and functionality, WorkingPoint transforms the traditionally tedious task of expense tracking into an engaging and insightful process.

Key Features

1. Intuitive Expense Tracking

WorkingPoint excels in simplifying expense tracking. Its intuitive interface ensures that recording and categorizing expenses becomes a seamless process, allowing users to maintain an organized financial record effortlessly.

2. Customizable Reporting

One key feature is the tool’s ability to generate customizable reports. Users can tailor reports to suit their specific financial needs, providing a detailed and personalized overview of their expenses.

3. Integration Capabilities

WorkingPoint stands out with its integration capabilities. It seamlessly connects with various financial platforms, streamlining the process of importing data and ensuring real-time accuracy in expense tracking.

Pros

1. User-Friendly Interface

The tool’s user-friendly interface is a standout advantage. Even users with limited financial expertise can navigate the system comfortably, making it accessible to a broad audience.

2. Comprehensive Financial Management

Beyond expense tracking, WorkingPoint offers a comprehensive financial management experience. From invoicing to inventory management, it serves as an all-in-one solution for small businesses and freelancers.

Cons

1. Learning Curve

Some users may experience a slight learning curve when first engaging with WorkingPoint. However, this initial learning phase is outweighed by the long-term benefits of efficient expense tracking and financial management.

2. Limited Automation

Compared to more advanced tools, WorkingPoint may have limited automation features. Users seeking extensive automation might find this aspect less comprehensive.

Frequently Asked Questions About WorkingPoint

Can WorkingPoint handle multiple currencies?

Yes, WorkingPoint supports multiple currencies, making it a versatile choice for businesses operating in diverse international markets.

How secure is the data in WorkingPoint?

WorkingPoint prioritizes data security, employing encryption and secure protocols to safeguard user information. Regular updates and maintenance contribute to a secure user experience.

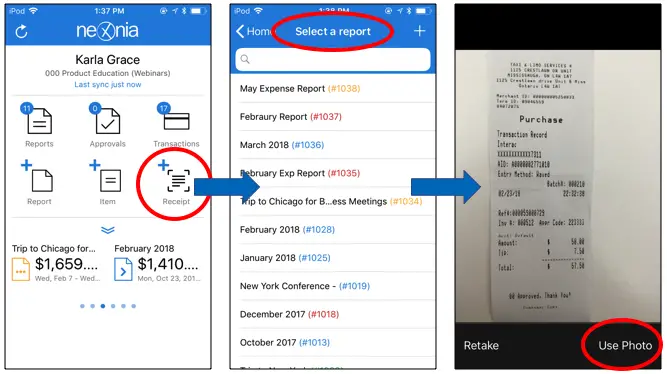

7. Nexonia Expenses

Embarking on the journey of financial management with Nexonia Expenses is akin to having a personal financial assistant in your pocket.

Simply think about having an easy-to-use, AI-powered buddy that helps you easily manage your spending and adjusts to your specific financial situation.

The AI in Nexonia Expenses works in unison with your everyday activities to make the tiresome task of tracking expenses more efficient from the minute you interact with it.

As you navigate the user-friendly interface, the AI engine quietly works behind the scenes, automating intricate tasks with precision.

There’s a certain magic in witnessing your expenses intelligently categorized and organized, all without manual input. This isn’t just technology; it’s a financial ally that simplifies the complexities of your financial life.

The AI isn’t just crunching numbers; it’s deciphering patterns, learning from your spending habits, and providing valuable insights into your financial landscape. It adapts to your needs, ensuring a tailored and personalized experience.

Nexonia’s AI-driven policy compliance checks become your financial guardian, alerting you to potential policy violations and ensuring your financial decisions align with company guidelines.

Key Features

1. Smart Receipt Scanning

One of Nexonia’s standout features is its smart receipt scanning capability. The tool employs advanced OCR (Optical Character Recognition) technology to automatically extract information from receipts, minimizing manual data entry.

2. Policy Compliance Checks

Nexonia goes beyond simple expense tracking by incorporating policy compliance checks. It ensures that submitted expenses adhere to company policies, reducing the risk of non-compliance and promoting financial responsibility.

3. Real-time Reporting

The tool provides real-time reporting functionalities, allowing users to access up-to-the-minute financial data. This feature is particularly beneficial for businesses requiring timely and accurate insights into their expenses.

Pros

1. User-Friendly Interface

Nexonia boasts a user-friendly interface, making it accessible for users with varying levels of financial expertise. The intuitive design contributes to a positive user experience.

2. Mobile Accessibility

With a dedicated mobile app, Nexonia enables users to manage expenses on the go. This mobile accessibility enhances flexibility and ensures that users can stay on top of their finances anytime, anywhere.

Cons

1. Learning Curve for Advanced Features

While the basics are user-friendly, some users may experience a learning curve when delving into more advanced features. However, this complexity is balanced by the tool’s comprehensive capabilities.

2. Cost for Additional Features

Certain advanced features may come with additional costs. Users looking to leverage the full spectrum of Nexonia’s capabilities should be mindful of potential extra expenses.

Frequently Asked Questions About Nexonia

Is Nexonia Expenses suitable for small businesses?

Yes, Nexonia caters to businesses of various sizes, offering scalable solutions that can be customized to meet the specific needs of small and large enterprises alike.

How secure is the data in Nexonia Expenses?

Nexonia prioritizes data security, employing encryption measures and secure protocols to protect user information. Regular updates and compliance with industry standards contribute to a secure user experience.

8. Everlance

Everlance is more than an AI expense tracker; it’s your financial ally. As you explore its functionalities, you’ll discover a tool that seamlessly integrates into your life, making expense tracking a valuable and stress-free experience.

Everlance, a leading AI Expense Tracker App, operates seamlessly to simplify your expense tracking experience.

Without requiring human input, the software effectively records and arranges your spending as you use it, saving you significant time and work.

Its sophisticated algorithms and user-friendly design combine to create a magical system that can recognise and classify your purchasing habits.

You’ll immediately notice Everlance’s user-friendly UI, which is made to make even people who aren’t as knowledgeable about financial lingo feel at ease using the programme.

Everlance works in the background, undetectable, to log and intelligently identify your transactions as you go about your day, whether for personal or professional purposes.

Everlance isn’t just about tracking expenses; it’s a financial confidant that adapts to your lifestyle. Imagine the convenience of having a tool that not only records your transactions but actively contributes to your financial success.

It’s a companion that offers insights, suggesting opportunities to save and guiding you towards financial efficiency.

Everlance stands out as an exceptional AI expense tracker, offering a range of features that cater to both individual users and businesses.

Key Features

1. Automatic Mileage Tracking

Everlance excels in automatically tracking mileage, making it an invaluable tool for individuals who need to log business-related travel. The app uses GPS technology to accurately record distances traveled.

2. Expense Logging

The app allows users to log various expenses effortlessly. Whether it’s meals, gas, or office supplies, Everlance simplifies the process, ensuring that users maintain a detailed record of their expenditures.

3. Real-Time Reporting

One of the standout features is the ability to generate real-time reports. Users can access instant insights into their spending patterns, helping them make informed financial decisions.

Pros

1. User-Friendly Interface

Everlance boasts a user-friendly interface, ensuring that even those unfamiliar with expense tracking apps can navigate and use its features seamlessly.

2. Cross-Platform Compatibility

The app’s compatibility across different platforms, including iOS and Android, enhances its accessibility, allowing users to manage their expenses from various devices.

Cons

1. Limited Free Version

While Everlance offers a free version, it comes with limitations. Users seeking more advanced features may need to subscribe to the premium version, which could be a drawback for those on a tight budget.

2. Learning Curve for Advanced Features

Some of the more advanced features, such as detailed tax tracking, may have a slight learning curve for users unfamiliar with complex financial terminology.

Frequently Asked Questions About Everlance

Is Everlance suitable for small businesses?

Absolutely. Everlance caters to both individual users and businesses, offering features like receipt scanning and mileage tracking that can benefit small businesses.

How does Everlance handle data security?

Everlance prioritizes data security, employing encryption and secure servers to protect user information. The app is designed with privacy in mind, ensuring user data remains confidential.

9. NerdWallet

NerdWallet is like having a trusted guide by your side, seamlessly navigating the complex terrain of expenses. As you explore the world of financial management, NerdWallet stands out as a reliable companion, utilizing advanced AI technology to simplify and enhance your financial experience.

In the realm of expense tracking, NerdWallet takes a unique approach. It doesn’t just monitor your spending; it engages with your financial story, employing algorithms to understand your habits, preferences, and financial goals.

This personalized touch sets it apart, transforming mere expense tracking into a tailored financial journey. Beyond just classifying your expenses, NerdWallet interprets the story behind each transaction to give you a comprehensive picture of your spending patterns.

Real-time insights are provided by NerdWallet without being intrusive. It runs smoothly in the background. It is like to having a financial advisor that gently guides you towards more prudent financial decisions by whispering pertinent suggestions.

This subtle guidance is woven into the fabric of your daily financial activities, making NerdWallet an integral part of your financial routine.

What sets NerdWallet apart is its commitment to education. As you explore the platform, articles and videos pop up, providing insights on budgeting, investing, and navigating the financial terrain.

It’s not just about tracking expenses; NerdWallet aims to empower you with knowledge, helping you make informed financial decisions.

Key Features

1. Comprehensive Financial Dashboard

NerdWallet offers a centralized dashboard that aggregates financial data from various accounts, providing users with a holistic view of their expenses, income, and overall financial health.

2. AI-Driven Expense Categorization

Leveraging artificial intelligence, NerdWallet excels in automatically categorizing expenses. This smart feature reduces manual input, saving time and ensuring accuracy in expense tracking.

3. Budgeting Tools

The tool provides robust budgeting capabilities, allowing users to set and customize budgets based on different categories. Real-time tracking against these budgets enables proactive financial management.

Pros

1. User-Friendly Interface

NerdWallet’s interface is user-friendly, making it accessible to individuals with varying levels of financial expertise. The intuitive design ensures a seamless experience for users navigating the platform.

2. Educational Resources

Beyond expense tracking, NerdWallet stands out for its educational resources. The platform offers articles, guides, and videos that empower users with financial knowledge, fostering informed decision-making.

Cons

1. Limited Investment Tracking

While excelling in expense tracking, NerdWallet may have limited features for in-depth investment tracking. Users heavily focused on detailed investment analytics might find this aspect less comprehensive.

2. Sensitivity to Connectivity Issues

Occasionally, users may experience sensitivity to connectivity issues, impacting the real-time syncing of data. While infrequent, this aspect is essential to note for users reliant on instant updates.

Frequently Asked Questions About NerdWallet

How secure is NerdWallet in handling sensitive financial information?

NerdWallet prioritizes security, employing encryption and secure protocols to protect user data. Regular security updates and adherence to industry standards contribute to a secure user experience.

Can I connect NerdWallet to multiple bank accounts?

Yes, NerdWallet supports the connection of multiple bank accounts, streamlining the process of consolidating financial data for comprehensive expense tracking.

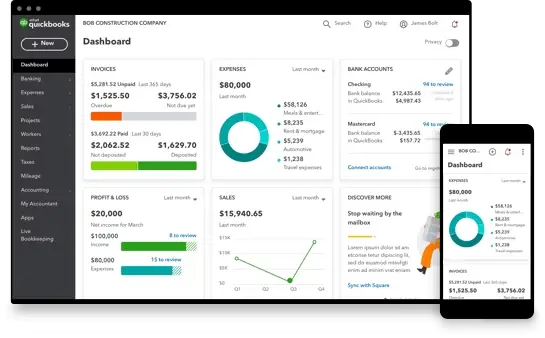

10. QuickBooks GoPayment

QuickBooks GoPayment makes expense tracking easy. Consider a solution that integrates into your daily transactions to simplify financial management. It integrates with your financial life as you use it.

Upon setting up the app, it effortlessly syncs with your various payment methods, transforming your smartphone into a portable financial hub. No need for complex spreadsheets; QuickBooks GoPayment streamlines your expenses in the palm of your hand.

Navigating through the app feels like having a personal financial assistant at your fingertips. It categorizes your expenses on the go, offering real-time insights into your spending patterns.

With a few taps, you gain a clear overview of where your money is flowing, empowering you to make informed decisions on the spot.

QuickBooks GoPayment doesn’t just stop at tracking expenses; it becomes a catalyst for financial awareness.

Through unobtrusive notifications and prompts, it gently guides you towards better financial habits. The app’s friendly interface ensures that managing your expenses is not a chore but a seamless part of your daily routine.

Reflecting on my personal experience, QuickBooks GoPayment entered my financial landscape, providing a level of convenience that transformed the way I interacted with my expenses. The app’s simplicity became a key ally, allowing me to stay on top of my financial game effortlessly.

Key Features

1. Seamless Integration

QuickBooks GoPayment seamlessly integrates with various payment methods, transforming your smartphone into a portable financial hub.

2. Real-time Expense Tracking

The app categorizes expenses on the go, offering real-time insights into your spending patterns.

3. User-Friendly Interface

Navigating through the app is intuitive, making financial management accessible to users of all levels.

4. Financial Guidance

QuickBooks GoPayment provides unobtrusive notifications and prompts, guiding users towards better financial habits.

Pros

1. Convenience

The app adapts to your lifestyle, making expense tracking a seamless part of your daily routine.

2. Real-Time Insights

Gain clear and immediate insights into your financial activities.

3. Financial Awareness

The app fosters financial awareness, helping users make informed decisions.

Cons

1. Feature Limitations

While versatile, QuickBooks GoPayment may not have advanced features present in specialized expense trackers.

2. Learning Curve

Users unfamiliar with financial apps might experience a slight learning curve.

Frequently Asked Questions About QuickBooks

How does QuickBooks GoPayment simplify expense tracking?

QuickBooks GoPayment simplifies tracking by categorizing expenses in real-time, providing immediate insights into spending patterns.

Can QuickBooks GoPayment help me with financial decisions?

Yes, the app offers financial guidance through notifications, empowering users to make informed decisions.

Reflecting on my personal experience, QuickBooks GoPayment entered my financial landscape, providing a level of convenience that transformed the way I interacted with my expenses.

The app’s simplicity became a key ally, allowing me to stay on top of my financial game effortlessly.

Final Thoughts

We’ve found the best AI expense tracker apps to help you manage your money. Imagine a world where you no longer have to worry about where your money is going.

With the right AI expense tracker app, you can easily track your spending, set savings goals, and make informed financial decisions.

Think of these apps as your personal financial assistants, working hard behind the scenes to help you reach your financial goals. With their help, you can spend less time on budgeting and more time enjoying life.

So, go out and conquer your financial frontiers with the best AI expense tracker apps. Keep your budgets balanced, your savings strong, and your financial future bright.