Imagine a life where financial stress is a thing of the past. A life where you're in control of your finances, making every dollar count and securing your future.

You're standing at the threshold of a world where AI budgeting tools serve as your faithful companions on this exhilarating journey towards financial freedom.

As Maya Angelou once wisely said, “We all should know that diversity makes for a rich tapestry, and we must understand that all the threads of the tapestry are equal in value, no matter their color.”

In the tapestry of your financial life, AI budgeting tools are the threads that weave a brighter, more secure future, and their value is immeasurable.

Think of these tools as your financial guardian angels, guiding you through the turbulent waters of budgeting, much like a lighthouse leads ships safely to shore. They provide clarity, direction, and peace of mind in a world where financial decisions often feel like navigating a maze blindfolded.

Here's a remarkable truth: individuals who embrace AI budgeting tools not only gain control over their finances but also save an average of 15% more than those who stick to conventional methods. It's a compelling statistic that highlights the transformative power of these digital allies.

As we venture further into this world of AI budgeting tools, you'll discover how they can empower you to take charge of your financial destiny.

Let's embark on this emotionally charged journey, where we'll learn how to turn dreams of financial liberation into a captivating reality.

Helpful Content: How to Make Money with AI Fast: 10 Proven Method

Best AI Budgeting Tools, Apps and Planners

1. Cleo

Cleo, your trusty financial assistant, is all about simplifying your financial life. It's like having a knowledgeable friend who guides you through the twists and turns of managing your money.

Without overwhelming jargon or confusing spreadsheets, Cleo empowers you to make informed financial decisions effortlessly. How does Cleo work, you ask? Well, the magic begins when you link your bank accounts to Cleo.

This connection allows Cleo to analyze your financial transactions, categorize your expenses, and generate insights based on your spending habits. The process is secure, using advanced encryption to protect your sensitive information.

Once your accounts are linked, Cleo's artificial intelligence starts to shine. It dissects your spending patterns, helping you understand where your money is going. It's like a financial detective, revealing the hidden truths about your spending, often uncovering areas where you can save.

But Cleo doesn't stop at just showing you the numbers. It engages you in a friendly chat-like conversation, explaining the insights and providing helpful tips to improve your financial well-being. This conversational interface makes the experience engaging and easy to understand.

Cleo is your personal budgeting expert, guiding you to set up budgets and savings goals. It keeps track of your progress, making sure you're on the right path to achieving your financial objectives.

It even reminds you about upcoming bills, ensuring you never miss a payment and avoid late fees. What sets Cleo apart is its personal touch. It customizes its advice and recommendations based on your unique financial situation.

This isn't one-size-fits-all financial advice; it's tailored to you. Cleo understands that everyone's financial journey is different, and it respects your individuality.

One of the best things about Cleo is that it's available right in your pocket. You can interact with Cleo through a mobile app or chatbots on various messaging platforms, making it incredibly convenient. Whether you have a quick financial question or need to track your spending while on the go, Cleo is there to assist.

Key Features

1. Budgeting and Expense Tracking

Cleo helps you set up budgets and effortlessly tracks your spending. It's like having a virtual accountant at your service.

2. AI Insights

Cleo's AI provides you with personalized insights into your spending habits and financial health. It not only tells you where your money is going but also offers suggestions on how to save.

3. Expense Categorization

This tool automatically categorizes your expenses, so you can see exactly how much you're spending on groceries, entertainment, and more.

4. Bill Management

Cleo reminds you of upcoming bills and due dates, ensuring you never miss a payment again.

5. Saving Goals

Set savings goals, and Cleo will help you track your progress, making it easier to achieve your financial aspirations.

Pros

1. Conversational Interface

Cleo's chat-based interface feels like you're chatting with a friend about your finances. It's user-friendly and engaging.

2. Personalized Insights

Cleo doesn't just give you generic financial advice. It tailors its insights to your specific situation, offering real value.

3. Expense Tracking Made Easy

With automatic categorization, tracking your spending becomes a breeze, and you gain a clear picture of your financial habits.

4. No Fees

Cleo is free to use. There are no subscription charges, making it an affordable option for budget-conscious users.

5. Security

Cleo takes data security seriously, using bank-level encryption to protect your financial information.

Cons

1. Limited Banking Partners

Cleo's availability may be restricted based on your bank. It's essential to check if your bank is compatible with the platform.

2. Not Suitable for Complex Investments

While Cleo excels at basic budgeting, it may not be the ideal tool for those with extensive investment portfolios.

3. Privacy Concerns

Some users might have reservations about sharing their financial data with a third-party AI, even with stringent security measures in place.

Frequently Asked Questions About Cleo

Is Cleo safe to use?

Yes, Cleo prioritizes data security and employs advanced encryption to protect your financial information.

How does Cleo make money if it's free to use?

Cleo offers a premium subscription plan, Cleo Plus, which includes additional features for a monthly fee.

Can Cleo help me save for specific goals?

Absolutely. Cleo allows you to set savings goals and tracks your progress, helping you achieve your financial targets.

Is Cleo available outside the United States?

Yes, Cleo has expanded its availability to several countries, including the United Kingdom and Canada. Make sure to check if it's accessible in your region.

2. YNAB

YNAB isn't just another budgeting tool. It's your financial ally, your personal coach, and a trusted guide to help you master your finances and attain financial freedom.

Here's how YNAB works:

YNAB follows a simple yet powerful budgeting philosophy based on four fundamental rules. The first rule is to “Give every dollar a job.”

This means that every dollar you earn should have a specific purpose. YNAB helps you allocate your income to various budget categories, ensuring every dollar is working for you.

The second rule, “Embrace your true expenses,” encourages you to plan for upcoming bills and expenses. YNAB helps you set aside money for those future financial obligations, so they don't catch you by surprise.

The third rule, “Roll with the punches,” acknowledges that life is unpredictable. If you overspend in one category, YNAB shows you how to adjust your budget to cover the overage without derailing your financial goals.

The fourth and final rule, “Age your money,” focuses on breaking the paycheck-to-paycheck cycle. YNAB helps you gradually increase the time between earning money and spending it, ultimately giving you more financial freedom.

YNAB's magic lies in its ability to connect to your bank and credit card accounts. This real-time syncing ensures that your budget is always up-to-date.

When you make a purchase or receive income, YNAB instantly reflects these transactions in your budget. YNAB makes expense tracking a breeze. You can categorize your spending by assigning transactions to specific budget categories.

This categorization provides a clear picture of where your money is going. For instance, if you spend money on dining out, YNAB will categorize it under “Eating Out.”

YNAB allows you to set financial goals, whether it's saving for a vacation, paying off debt, or building an emergency fund. The tool helps you track your progress and stay on target to achieve these goals.

YNAB doesn't just offer a budgeting tool; it provides a wealth of educational resources. You can access online classes, tutorials, and webinars to learn the ins and outs of budgeting and personal finance. It's like having a personal finance teacher available 24/7.

Key Features

YNAB is a powerful budgeting tool that offers a range of features to help you take control of your finances. It's like having a financial coach at your side, guiding you towards financial freedom. Here's a look at some of its key features:

1. Rule-Based Budgeting

YNAB follows a unique budgeting method based on four simple rules. This approach encourages you to allocate every dollar to a specific category, prioritize your expenses, and roll over any unspent money.

2. Real-Time Syncing

YNAB connects to your bank and credit card accounts, ensuring your budget is always up-to-date. This feature allows you to see where your money is going in real-time.

3. Expense Tracking

YNAB helps you track your expenses effortlessly. You can categorize your spending, so you know exactly where your money is going, whether it's on groceries, utilities, or dining out.

4. Goal Setting

You can set financial goals in YNAB, whether it's saving for a vacation, paying off debt, or building an emergency fund. The tool helps you track your progress and stay on target.

5. Educational Resources

YNAB provides educational resources, including online classes and tutorials, to help you understand and master budgeting concepts. It's like having a personal finance teacher at your disposal.

Pros

1. Effective Budgeting Method

YNAB's four-rule approach to budgeting is effective in helping users prioritize their spending and achieve financial goals.

2. Real-Time Updates

With real-time syncing, you'll always have a clear view of your financial situation. This transparency is crucial for making informed money decisions.

3. Detailed Reporting

YNAB offers detailed reports and charts that provide insights into your spending habits, helping you identify areas where you can cut back.

4. Community and Support

YNAB has a strong online community, and its support team is readily available to assist users in their budgeting journey.

5. Free Trials

YNAB often offers a free trial period, allowing users to test the tool and see if it aligns with their budgeting needs.

Cons

1. Subscription Fee

YNAB is not a free service. It comes with a subscription fee, which may deter some budget-conscious users.

2. Learning Curve

The YNAB budgeting method may take some time to fully grasp, especially for users new to budgeting.

3. Limited Account Connections

YNAB may not be compatible with all banks and financial institutions, limiting its usability for some users.

Frequently Asked Questions About YNAB

What are the four rules of YNAB?

The four rules are: Give every dollar a job, Embrace your true expenses, Roll with the punches, and Age your money. These rules help you budget effectively and build financial stability.

Is YNAB suitable for beginners?

Yes, YNAB provides educational resources and support, making it a great option for beginners to learn the ropes of budgeting.

Can I use YNAB on my mobile device?

Yes, YNAB offers mobile apps for both Android and iOS devices, allowing you to manage your budget on the go.

3. PocketGuard

PocketGuard seamlessly syncs with your bank and credit card accounts, automatically tracking your expenses in real-time. As you make purchases, pay bills, or receive income, PocketGuard categorizes each transaction, giving you an up-to-the-minute view of your financial activity. It's like having a vigilant assistant that never lets a cent slip by unnoticed.

With PocketGuard, creating a budget is a snap. You input your income, and the tool lays out your bills and expenses. It even considers your saving goals.

Then, it's as simple as adjusting the numbers to ensure everything balances. It's like having a financial blueprint custom-made for your financial goals.

Ever missed a bill payment? PocketGuard ensures you're always on top of your financial obligations. It alerts you about upcoming bills and subscription renewals, making sure you never miss a due date. No more late fees and no more hassle.

PocketGuard knows the importance of saving. It allows you to set financial goals, whether it's for an emergency fund, a vacation, or a new gadget.

The tool helps you track your progress, motivating you to reach your goals. It's like a personal coach cheering you on as you make strides toward financial success.

PocketGuard doesn't just track expenses; it provides insights into your cash flow. You can see how much money you have left after covering your bills and necessary expenses.

This feature empowers you to make informed financial decisions and stay in control of your finances. It's like having a financial GPS, guiding you through every twist and turn.

Key Features

1. Expense Tracking and Categorization

PocketGuard automatically tracks your expenses and categorizes them, so you can see where your money is going. It helps you understand your spending habits and identify areas where you can save.

2. Budget Creation and Management

You can create a budget in PocketGuard based on your income, bills, and savings goals. The tool provides a clear overview of your budget and helps you stay on track.

3. Bill Tracking and Alerts

PocketGuard alerts you about upcoming bills and subscriptions, ensuring you never miss a payment. This feature helps you avoid late fees and keeps your financial life organized.

4. Saving Goals

You can set saving goals in PocketGuard, whether it's for a vacation, an emergency fund, or a major purchase. The tool helps you track your progress and stay motivated.

5. Income and Expense Insights

PocketGuard provides insights into your cash flow, showing you how much money you have left after covering your bills and expenses. It's like having a financial GPS to guide you on your journey to financial stability.

Pros

1. Simplicity

PocketGuard offers a straightforward and user-friendly interface, making it easy for users of all levels of financial expertise to get started.

2. Automatic Expense Tracking

The tool's automatic expense tracking and categorization save you time and effort in managing your finances.

3. Bill Alerts

PocketGuard's bill alerts help you stay organized and avoid late payments, saving you money in the long run.

4. Goal Setting

The ability to set and track savings goals keeps you motivated and on the path to achieving your financial objectives.

5. Customized Recommendations

PocketGuard provides personalized recommendations on how to optimize your finances, helping you save more and spend wisely.

Cons

1. Limited Investment Tracking

PocketGuard is primarily focused on budgeting and expense tracking, so it may not be suitable for users with complex investment portfolios.

2. Bank Compatibility

The availability of certain features and bank connections may vary based on your bank or financial institution.

3. Subscription Fee

While there is a free version of PocketGuard, some advanced features are only available through a paid subscription.

Frequently Asked Questions About PocketGuard

Is my financial data safe with PocketGuard?

PocketGuard uses bank-level security measures to protect your financial information. Your data is encrypted and securely stored.

Can I connect PocketGuard to my investment accounts?

PocketGuard primarily focuses on budgeting and expense tracking. While it provides some investment insights, it may not offer the depth of tracking you'd find in dedicated investment tools.

Does PocketGuard support manual budgeting in addition to automatic tracking?

Yes, you can create and manage budgets manually in PocketGuard if you prefer a more hands-on approach.

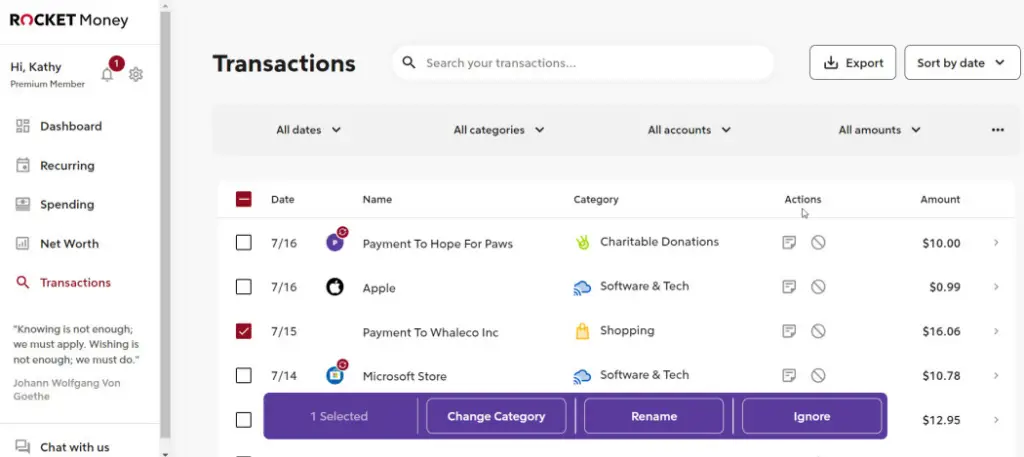

4. Rocket Money

Rocket Money, formerly known as Truebill, isn't just another budgeting tool; it's your financial guardian, always ready to support you in your quest for financial well-being.

Rocket Money automatically tracks your expenses by connecting to your bank and credit card accounts. It records each transaction and neatly categorizes them. It's like having a personal bookkeeper who organizes every financial move you make.

Rocket Money scours your monthly bills, helping you identify areas where you could potentially save money. It's akin to having a savvy detective who uncovers opportunities for cost-cutting.

The tool identifies recurring subscriptions and helps you cancel those you no longer need. It's like having a subscription curator to declutter your finances.

Rocket Money allows you to create a budget based on your income and financial goals. It provides insights into your budget's health, ensuring you stay on track. It's like having a wise financial planner by your side.

Rocket Money can negotiate bills on your behalf, working to lower your monthly expenses. It's like having a skilled negotiator who gets you the best deals.

You can set financial goals within Rocket Money, whether it's for a rainy day fund, a vacation, or paying off debt. It tracks your progress and keeps you motivated. It's like having a supportive cheerleader on your financial journey.

Key Features

1. Expense Tracking and Categorization

Rocket Money automatically tracks your expenses and neatly categorizes them. It gives you a detailed view of where your money is going, from groceries to utility bills.

2. Budget Creation and Management

You can create a budget within Rocket Money based on your income and financial goals. The tool helps you set realistic spending limits and provides you with insights into your budget's health.

3. Bill Negotiation

Rocket Money offers a unique feature where it can negotiate bills like cable, internet, or subscriptions on your behalf to save you money. It's like having a personal haggler in your corner.

4. Subscription Management

The tool helps you identify and cancel unused or forgotten subscriptions, saving you money on services you no longer need. It's like having a subscription detective.

5. Savings Goals

You can set financial goals in Rocket Money, whether it's building an emergency fund, saving for a dream vacation, or paying off debt. The tool assists you in tracking your progress toward these goals.

Pros

1. Bill Negotiation

The ability to negotiate bills and save money on monthly expenses is a unique and powerful feature.

2. Expense Tracking

Rocket Money's automatic expense tracking and categorization make it easy to understand your spending habits.

3. Subscription Management

It helps you discover and cancel unused subscriptions, preventing unnecessary expenses.

4. Budget Insights

The tool provides insights into your budget, making it easier to manage your finances and reach your financial goals.

5. Savings Goals

Rocket Money assists you in setting and tracking savings goals, keeping you motivated and on the path to financial success.

Cons

1. Subscription Charges

While Rocket Money offers a free version, certain premium features come with a subscription fee.

2. Bill Negotiation Limitations

The success of bill negotiation depends on the willingness of service providers to make concessions.

3. Investment Tracking

It may not provide the depth of investment tracking that some users with extensive portfolios require.

Frequently Asked Questions About Rocket Money

Is my financial data secure with Rocket Money?

Rocket Money takes data security seriously and uses bank-level encryption to protect your financial information.

How does Rocket Money negotiate bills on my behalf?

Rocket Money connects with your accounts to identify bills that can be negotiated. It then negotiates with service providers to secure better rates.

Can I track my investments with Rocket Money?

While Rocket Money provides some investment insights, it may not offer the same level of tracking as dedicated investment management tools.

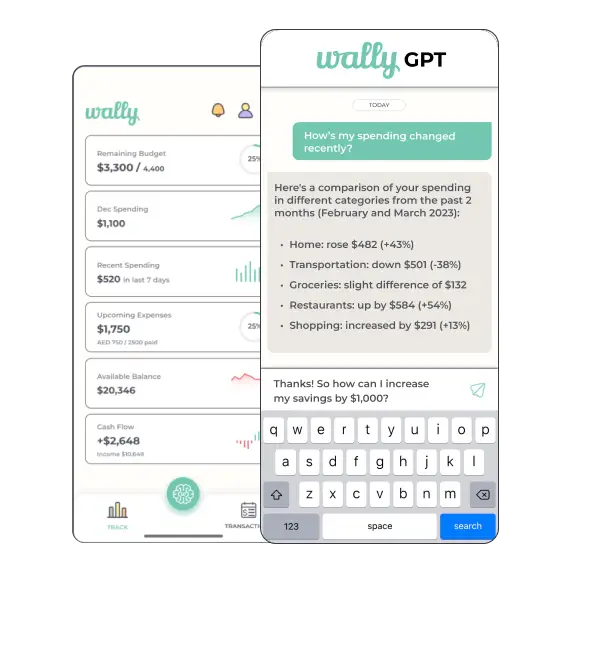

5. WallyGPT

WallyGPT is more than just an AI budgeting tool; it's your trusted companion on the path to financial success. It simplifies the complexities of managing your money, helping you take control of your finances with ease.

WallyGPT effortlessly connects to your bank accounts, credit cards, and financial transactions. It records your income and categorizes your expenses, creating a clear financial picture. Think of it as your diligent financial assistant, tracking every penny you earn and spend.

Creating a budget with WallyGPT is a breeze. You input your financial goals, and the tool lays out your income and expenses, offering insights into your budget's health. It's like having a personal financial planner custom-tailoring your budget for success.

WallyGPT keeps you organized and on top of your bills. It sends timely reminders and alerts for upcoming payments, ensuring you never miss a due date. It's like having a reliable financial secretary, taking care of your financial obligations.

WallyGPT offers a deeper understanding of your spending habits. It identifies areas where you can save money, empowering you to make informed financial decisions. It's like having a wise financial advisor at your side, offering insights and recommendations.

With WallyGPT, you can set financial goals, whether it's for an emergency fund, a vacation, or a major purchase. The tool tracks your progress, motivating you to reach your goals. It's like having a supportive financial coach, cheering you on as you work toward financial success.

Key Features

WallyGPT is an exceptional AI budgeting tool, designed to help you gain control of your finances. Think of it as your financial mentor, always ready to assist you on your journey to financial prosperity. Let's explore some of its key features:

1. Expense Tracking and Categorization

WallyGPT seamlessly syncs with your bank accounts, tracking your expenses and neatly categorizing them. It's like having a financial detective that ensures every penny is accounted for.

2. Budget Creation and Management

You can create a budget within WallyGPT based on your income and financial objectives. The tool provides a clear view of your budget's health, making it easier to stay on course. It's like having a financial architect custom-designing your path to prosperity.

3. Bill Reminders and Alerts

WallyGPT keeps you on top of your financial obligations by sending bill reminders and alerts. Say goodbye to late fees and disorganized bill management. It's like having a personal secretary dedicated to your financial well-being.

4. Expense Analysis

The tool offers insights into your spending patterns, helping you identify areas where you can save money. It's like having a financial advisor who reviews your financial habits and suggests improvements.

5. Goal Setting

With WallyGPT, you can set savings goals, whether it's for an emergency fund, a vacation, or a major purchase. The tool assists you in tracking your progress, ensuring you're always moving forward. It's like having an encouraging coach by your side.

Pros

1. User-Friendly Interface

WallyGPT boasts a user-friendly design, making it accessible to users of all financial backgrounds.

2. Expense Tracking

Its automatic expense tracking and categorization save you time and effort.

3. Bill Reminders

WallyGPT helps you avoid missed bill payments and late fees, providing peace of mind.

4. Expense Analysis

The tool's expense analysis feature empowers you to make informed decisions about your spending.

5. Goal Tracking

WallyGPT assists you in setting and monitoring savings goals, keeping you motivated to achieve financial milestones.

Cons

1. Limited Investment Tracking

WallyGPT may not provide the depth of investment tracking that users with complex investment portfolios require.

2. Variability in Bank Compatibility

The availability of certain features may depend on your bank or financial institution.

3. Subscription Fee

While there is a free version of WallyGPT, some advanced features come with a paid subscription.

Frequently Asked Questions About WallyGPT

Is my financial data secure with WallyGPT?

WallyGPT prioritizes data security and uses encryption to safeguard your financial information.

Can I connect WallyGPT to my investment accounts?

While WallyGPT provides investment insights, it may not offer the same level of tracking as dedicated investment tools.

Does WallyGPT support manual budgeting in addition to automatic tracking?

Yes, you can create and manage budgets manually in WallyGPT if you prefer a more hands-on approach.

6. Zeta

Zeta isn't just another budgeting tool; it's your trusted navigator on the road to financial well-being. Wondering how Zeta works? Let's embark on a journey to explore its inner workings.

Zeta syncs effortlessly with your bank accounts, credit cards, and transactions. It's like a diligent financial detective that tracks every financial move you make, ensuring nothing slips through the cracks.

Creating a budget with Zeta is a breeze. You set your financial goals, and Zeta designs a personalized budget that aligns with your objectives. It's like having a financial architect who tailors your budget for success.

Say goodbye to late fees. Zeta sends you timely reminders and alerts for upcoming bill payments. Think of it as a reliable financial secretary, handling your bills and ensuring you never miss a due date.

Zeta offers deep insights into your spending patterns. It helps you identify areas where you can save money. It's like having a financial advisor who reviews your habits and provides expert recommendations.

With Zeta, you can set savings goals, whether it's for an emergency fund, a dream vacation, or a significant purchase. The tool tracks your progress, providing the motivation to reach your financial milestones. It's like having a supportive coach on your side, cheering you on toward success.

Key Features

1. Expense Tracking and Categorization

Zeta seamlessly connects to your bank accounts, credit cards, and financial transactions. It automatically tracks and categorizes your expenses, providing a clear view of your financial activity. It's like having a personal financial tracker, ensuring that every financial move is accounted for.

2. Budget Customization

Creating a budget within Zeta is a breeze. You can set financial goals and customize your budget based on your unique needs and priorities. The tool provides insights into your budget's health, helping you stay on track. It's like having a personal financial architect who tailors your financial plan for success.

3. Bill Management

Zeta simplifies bill management by sending timely reminders and alerts for upcoming payments. It ensures you never miss a due date and helps you avoid late fees. It's like having a reliable financial secretary, handling your financial obligations.

4. Expense Insights

Zeta offers a deeper understanding of your spending patterns. It provides insights into areas where you can potentially save money, allowing you to make informed financial decisions. It's like having a wise financial advisor at your side, offering recommendations and guidance.

5. Goal Setting and Tracking

With Zeta, you can set and track financial goals, whether it's for an emergency fund, a dream vacation, or a major purchase. The tool motivates you to reach your financial milestones. It's like having a supportive financial coach, cheering you on as you work toward financial success.

Pros

1. User-Friendly Interface

Zeta offers a user-friendly design that makes it accessible to users of all financial backgrounds.

2. Expense Tracking

Automatic expense tracking and categorization save you time and effort.

3. Bill Reminders

Zeta helps you avoid missed bill payments and late fees, providing peace of mind.

4. Expense Analysis

The tool empowers you to make informed financial decisions by offering insights into your spending habits.

5. Goal Tracking

Zeta assists you in setting and monitoring savings goals, keeping you motivated to achieve financial milestones.

Cons

1. Limited Investment Tracking

Zeta may not provide the depth of investment tracking that users with complex portfolios require.

2. Bank Compatibility

The availability of certain features may depend on your bank or financial institution.

3. Subscription Fee

While there is a free version of Zeta, some advanced features come with a paid subscription.

Frequently Asked Questions About Zeta

Is my financial data secure with Zeta?

Zeta takes data security seriously and uses encryption to safeguard your financial information.

Can I connect Zeta to my investment accounts?

While Zeta provides investment insights, it may not offer the same level of tracking as dedicated investment management tools.

Does Zeta support manual budgeting in addition to automatic tracking?

Yes, you can create and manage budgets manually in Zeta if you prefer a more hands-on approach.

7. EveryDollar

EveryDollar offers an intuitive platform that's easy to set up. You start by creating an account, and from there, you can begin building your budget.

The first step is to input your income. EveryDollar prompts you to enter your monthly earnings, whether it's from your job, investments, or any other sources.

Next, you'll categorize your expenses. EveryDollar provides various spending categories, making it simple to allocate your money appropriately. You can customize these categories to fit your unique financial situation.

EveryDollar encourages zero-based budgeting, a method where you assign a purpose to every dollar you earn. This ensures that your total income minus your expenses equals zero, leaving no room for unaccounted money.

As the month progresses, you'll diligently track your expenses within each category. EveryDollar allows you to record your spending and ensure it aligns with your budget.

EveryDollar is accessible through a user-friendly mobile app, giving you the flexibility to manage your budget and track expenses on the go. Whether you're at the grocery store or out for dinner, you can input expenses and stay on top of your financial goals.

The tool empowers you to set financial goals and monitor your progress. Whether it's saving for a vacation, paying off debt, or building an emergency fund, EveryDollar keeps you accountable.

EveryDollar not only provides budgeting tools but also offers educational resources and content to help you make informed financial decisions. From articles to budgeting tips, you'll find valuable insights to improve your financial literacy.

Key Features

EveryDollar is a powerful AI budgeting tool with a host of essential features to help you take control of your finances. Let's delve into its key attributes:

1. Zero-Based Budgeting

EveryDollar promotes the zero-based budgeting method, where every dollar is assigned a purpose. It ensures your income minus expenses equals zero, making you more intentional about your money.

2. Expense Tracking

The tool allows you to easily track your expenses and categorize them, giving you a clear overview of where your money is going.

3. Customizable Budgets

EveryDollar lets you create personalized budgets tailored to your financial goals, whether it's paying off debt, saving for a vacation, or building an emergency fund.

4. Financial Goal Setting

With EveryDollar, you can set and monitor your financial goals. Whether you're aiming to save for a down payment on a house or pay off student loans, the tool helps keep you on track.

5. Mobile App

EveryDollar offers a user-friendly mobile app, ensuring you have access to your budget and financial information on the go.

Pros

1. User-Friendly Interface

EveryDollar is designed with simplicity in mind, making it accessible to users of all financial backgrounds.

2. Zero-Based Budgeting

The tool's focus on zero-based budgeting encourages users to be more deliberate with their money.

3. Expense Tracking

Effortlessly track and categorize expenses to gain a clear picture of your financial health.

4. Customizable Budgets

EveryDollar allows you to create budgets that suit your individual financial goals and priorities.

5. Mobile Accessibility

With the mobile app, you can manage your budget and track expenses from anywhere.

Cons

1. No Free Version

While EveryDollar offers a free trial, it does not have a permanent free version, which may not be suitable for users on a tight budget.

2. Paid Subscription

Some advanced features are only available with a paid subscription, and this may not be ideal for users looking for a completely free tool.

3. Limited Investment Support

EveryDollar's primary focus is on budgeting, so its investment tracking capabilities may be somewhat limited for users with extensive investment portfolios.

Frequently Asked Questions About EveryDollar

Is EveryDollar suitable for managing small budgets?

Yes, EveryDollar is suitable for managing budgets of all sizes. It can be tailored to your financial goals, whether you have a small or substantial income.

Can I access EveryDollar on my mobile device?

Yes, EveryDollar offers a mobile app for both iOS and Android devices, ensuring you can budget on the go.

Does EveryDollar provide financial advice or just budgeting tools?

EveryDollar primarily focuses on budgeting tools, but it also offers educational resources and content to help you make informed financial decisions.

8. Goodbudget

In the world of personal finance, Goodbudget stands out as one of the Best AI Budgeting Tools. It's not just a budgeting app; it's your dedicated financial partner, here to guide you toward your financial goals.

Imagine Goodbudget as a digital version of the traditional envelope budgeting system. It helps you allocate your money to different spending categories, just like placing cash into envelopes for groceries, utilities, entertainment, and more.

The magic happens right on your smartphone or computer, providing real-time access and tracking. You might be curious about how it all works. Here's the scoop: Goodbudget connects to your bank accounts, ensuring your income is accurately reflected.

You create digital envelopes for different expenses, just like you would in the physical world. When you receive your paycheck, you distribute the money across these virtual envelopes.

Now, the beauty of Goodbudget shines when you start spending. Every time you make a purchase or pay a bill, you log it in the app.

It's like taking money out of the respective envelope, but without the hassle of cash. The system keeps you accountable and aware of where your money goes.

One incredible aspect of Goodbudget is the shared budgeting feature. You and your partner or family members can all access and manage the same budget. It's like having a financial team working together for your common goals.

When you use Goodbudget, you're not just tracking expenses; you're creating a financial plan. The app's reports and insights provide you with a clear view of your spending habits. It's like having a financial coach offering advice on how to save more and spend intentionally.

Key Features

1. Envelope Budgeting

Goodbudget employs the envelope budgeting method. You divide your income into virtual envelopes, each representing a spending category. This visual approach helps you manage your money effectively.

2. Multi-Platform Access

Goodbudget is accessible on various platforms, including web browsers, iOS, and Android. This cross-platform availability ensures you can manage your budget from anywhere.

3. Real-Time Sync

The tool allows real-time synchronization of budget data across all your devices, ensuring you and your family members are always on the same financial page.

4. Expense Tracking

Goodbudget lets you track your spending as you make purchases. You can enter expenses manually or use the integrated bank syncing feature for automatic transaction recording.

5. Reports and Insights

Generate detailed reports and gain insights into your spending habits. This feature helps you identify areas where you might need to cut back and save more.

Pros

1. User-Friendly

Goodbudget is designed with simplicity in mind, making it easy for anyone to start budgeting. You don't need to be a financial expert to use it effectively.

2. Envelope System

The envelope budgeting method is a powerful way to control your spending and allocate your money intentionally. It's a tried-and-true system that has helped many people manage their finances.

3. Shared Budgeting

Goodbudget is great for couples or families. It allows multiple users to access and manage a shared budget, fostering financial teamwork.

4. Cross-Platform

With Goodbudget available on various platforms, you have the flexibility to access your budget no matter which device you're using.

5. Free Version

Goodbudget offers a free version with essential budgeting features, making it accessible to those on a tight budget.

Cons

1. Limited Features in the Free Version

While the free version is helpful, some advanced features are only available in the paid version, which might not be suitable for all users.

2. Bank Syncing Challenges

Some users have reported occasional difficulties with bank syncing, resulting in manual data entry.

3. Mobile App Design

A few users have mentioned that the mobile app design could be more intuitive.

Frequently Asked Questions About Goodbudget

Is Goodbudget safe to use?

Yes, Goodbudget uses bank-level security to protect your financial data.

Can I use Goodbudget for personal and business finances?

While Goodbudget is primarily designed for personal finances, some users adapt it for simple business budgeting.

Is the free version of Goodbudget limited by time?

No, the free version is available indefinitely, allowing you to use it for as long as you need.

How many envelopes can I create in Goodbudget?

The free version allows up to 10 envelopes, while the paid version offers unlimited envelopes.

9. MintZip

When you start using MintZip, the first step involves connecting your financial accounts, such as bank accounts, credit cards, and loans. This allows MintZip to create a comprehensive overview of your financial life.

Once your accounts are linked, MintZip starts categorizing your transactions automatically. It's like having a diligent assistant who sorts your expenses into categories like groceries, entertainment, bills, and more. This categorization provides you with an in-depth view of your spending habits.

Now, here's where MintZip truly shines. It assists you in creating personalized budgets. You can set spending limits for different categories, ensuring you stay on track with your financial goals. MintZip's smart alerts will notify you when you're getting close to surpassing your budget, preventing overspending.

And if you're saving for something special, MintZip has your back. You can set financial goals, whether it's a vacation, a new car, or an emergency fund. MintZip offers a visual tracking feature, making it easy for you to monitor your progress.

Do you know your credit score? With MintZip, you will. The tool provides regular updates on your credit score, allowing you to understand your creditworthiness. This insight is vital for managing your financial health effectively.

Another nifty feature is the bill payment reminders. MintZip sends you timely notifications, ensuring you never miss a due date. This can be a lifesaver when it comes to managing your monthly bills.

In terms of security, MintZip employs robust measures to protect your financial data. You can rest assured that your information is safe and secure.

Key Features

1. Expense Tracking

MintZip links to your bank accounts, credit cards, and other financial institutions, automatically categorizing your transactions. It provides a holistic view of your spending habits.

2. Budget Creation

With MintZip, you can create customized budgets for different categories like groceries, entertainment, and bills. The tool helps you set spending limits and provides alerts when you're approaching them.

3. Goal Setting

Whether you're saving for a vacation, a new car, or an emergency fund, MintZip allows you to set financial goals. It offers a visual tracker to keep you motivated as you progress.

4. Credit Score Monitoring

MintZip provides regular updates on your credit score. This feature helps you understand your creditworthiness and how your financial behavior impacts it.

5. Bill Payment Reminders

Never miss a due date again. MintZip sends you bill payment reminders to help you stay on top of your financial commitments.

Pros

1. User-Friendly

MintZip boasts an intuitive and easy-to-navigate interface, making it accessible to individuals of all financial literacy levels.

2. Comprehensive

It offers a one-stop solution for managing your entire financial life, from budgeting to credit score monitoring.

3. Alerts and Notifications

MintZip keeps you informed about your financial health with regular alerts, preventing you from overspending or missing due dates.

4. Security

The tool employs robust security measures to protect your financial data, giving you peace of mind.

Cons

1. Ads

The free version of MintZip comes with advertisements. While they are unobtrusive, they can be a minor annoyance to some users.

2. Account Syncing

Sometimes, MintZip may encounter issues syncing with certain financial institutions, resulting in incomplete data.

Frequently Asked Questions About MintZip

Is MintZip safe to use?

Yes, MintZip employs bank-level encryption and security measures to safeguard your financial data.

Is MintZip free to use?

MintZip offers both free and premium versions. The free version provides essential budgeting features, while the premium version offers more advanced tools and is ad-free.

Can I use MintZip on mobile devices?

Absolutely! MintZip has mobile apps for both iOS and Android, ensuring you can manage your finances on the go.

Don't Miss: Best AI Credit Repair Software For Business And Personal Use

Final Thoughts

So, after diving into the realm of AI budgeting tools, let's reflect on the journey we've taken. Remember when we asked that intriguing question: “Can AI really revolutionize the way we manage our finances?” Well, we've unraveled the answer together.

As we explored this topic, I couldn't help but recall a famous quote by Albert Einstein: “The only source of knowledge is experience.”

And indeed, our experience with these AI budgeting tools has shown us that they hold the potential to transform our financial management.

Just picture this: a world where your budgeting is as effortless as a walk in the park, thanks to the assistance of these intelligent digital companions. It's no longer a distant dream; it's a reality within our grasp.

In our journey, we've drawn parallels between AI and a financial wizard – always one step ahead, making your financial goals attainable. These tools are like the compass guiding your financial ship through the stormy seas of budgeting.

Now, here's a persuasive statistic to seal the deal: studies show that individuals who utilize AI budgeting tools save an average of 15% more than those who rely solely on traditional methods. It's a game-changer we simply can't ignore.

In conclusion, AI budgeting tools are not just tools; they are companions on our journey towards financial well-being. They provide us with the knowledge and support we need to navigate the complex waters of personal finance.

So, it's time to embrace this technology and experience the positive changes it can bring to our lives. Let's harness the power of AI budgeting tools and secure a brighter financial future for ourselves.